Business Insurance in and around San Antonio

Get your San Antonio business covered, right here!

No funny business here

State Farm Understands Small Businesses.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, worker's compensation for your employees and a surety or fidelity bond, among others.

Get your San Antonio business covered, right here!

No funny business here

Surprisingly Great Insurance

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Enrique Enriquez for a policy that covers your business. Your coverage can include everything from extra liability coverage or errors and omissions liability to key employee insurance or group life insurance if there are 5 or more employees.

Call Enrique Enriquez today, and let's get down to business.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

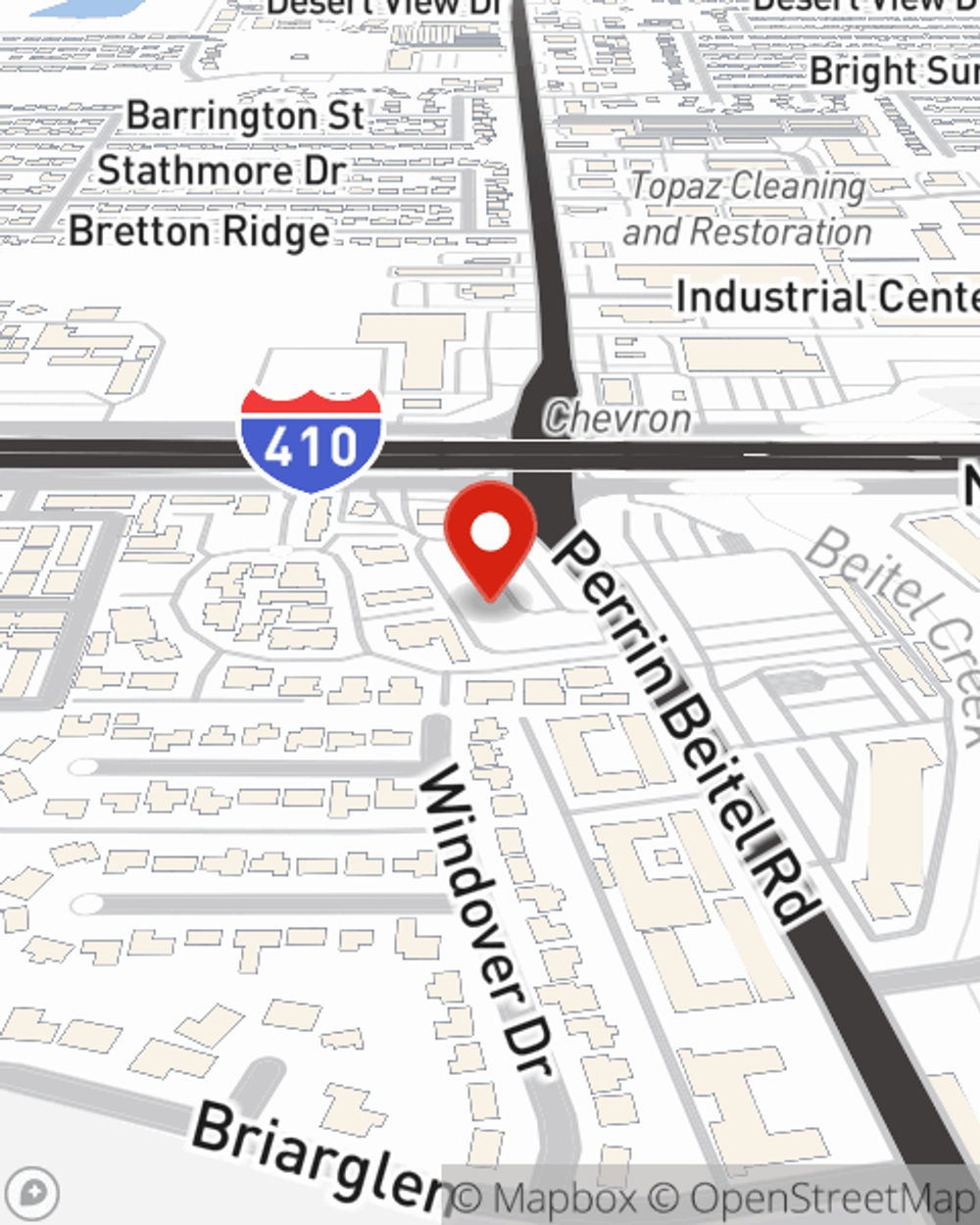

Enrique Enriquez

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.